Dossier – A Policy Mix for Reducing CO2 Emissions in the Transport Sector

Acknowledgement: This article was originally an academic essay written in collaboration with Kirsty McLennaghan, whom I thank for having agreed on publishing this article.

“The key to the fall has been cars”, writes Matt McGrath on a BBC article, one of the many reporting on the decrease in carbon dioxide (CO2) emissions that COVID lockdown resulted in. Among the many negative headline titles that this tragic period has brought upon us, this is certainly good news. However, such encouraging data were the product of social and economic disruption, a side effect of the mitigation strategies to stop the spread of the virus. In light of this fact, it is only natural to ask ourselves: how can we decrease CO2 emissions from the transport sector, without giving up the freedom and joy of movement? Scientific evidence shows that the answer lies in a carefully engineered policy mix.

This dossier explores, first, an overview of what CO2 emissions are, and what its main contributors are. Then, it moves onto a brief description of some policy levers which have been demonstrated to reduce CO2 emissions, and proposes a policy mix of the two in order to tackle the issue.

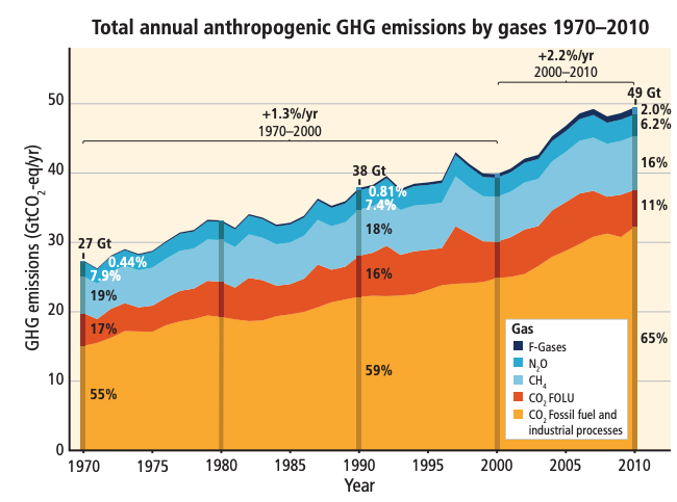

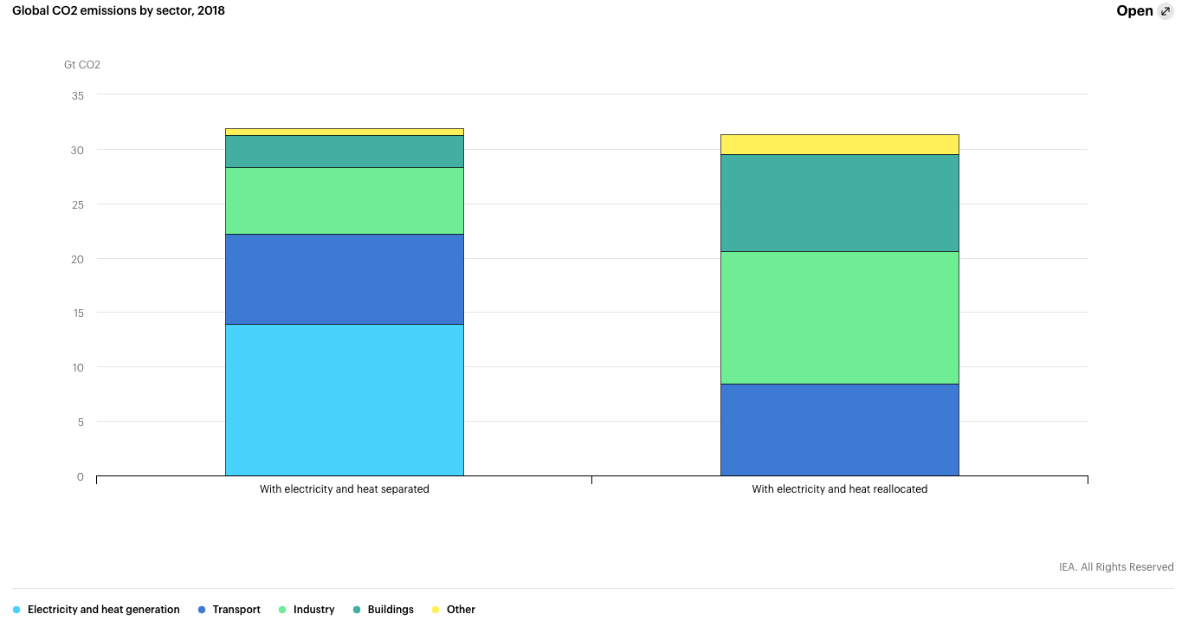

The fact that CO2 emissions fell when the world literally came to a stop is all but surprising. The intensification of industry, transport and agriculture to meet societies’ increasing demands and population is the leading cause of the increase in carbon emissions we have been witnessing for decades. As figure 1 shows, annual anthropogenic greenhouse gases (GHG) emissions have been rising, and this trajectory is of great concern because of how the change in climate will result in disruptions throughout the earth’s ecosystem. To limit global warming, it is imperative that GHG emissions are controlled and decline as soon as possible. According to the most influential studies and reports on the issue, transport is responsible for approximately a quarter of GHG emissions, as also shown in figure 2 below (IEA, 2018; IPCC, 2014). Addressing the transport sector is therefore a huge step in reducing global CO2 emissions.

Naturally, in tackling such complex issues, one has to deal with a large number of challenges and obstacles. In picturing the scale of the problem, it is enough to imagine what it takes to transition the transport sector away from fossil fuels. It is a colossal task, one that requires phasing out of diesel and gasoline vehicles, building infrastructure for low carbon transport and behavioural changes (Logan et al, 2020). Moreover, the transport sector has not been able to transition at the pace that is needed due to the absence of global legally binding deals in combination with the high cost of decarbonised vehicles and energy technologies (Santos, 2017). And finally, the transport sector faces the specific challenge that transport demand is continuously growing, with emissions desperately needing to be reduced (Krause et al., 2020).

Despite the complexity of the issue, governments and environmental protection agencies have different policy levers to choose from in dealing with CO2 emissions from the transport sector. In the scientific literature on emissions abatement, these are usually called: market-based instruments (MBIs), and command and control (CAC) regulations. The former, namely MBIs, act by generating economic incentives, while the latter, CAC instruments, impose regulation and limits. As a rule of thumb, MBIs (such as subsidies and carbon pricing) are more cost-effective with respect to CAC policy instruments but yield a moderate reduction in emissions, whilst CAC (such as technological standards and maximum permitted level of emissions) deliver the results in a shorter time span, at the cost of losing cost-effectiveness.

One of the most widespread MBIs levers to abate CO2 emissions in the transport sector is carbon pricing. Evidence from existing carbon taxation confirms both the efficacy and efficiency of the economic intuition behind it, although with significant changes in cross-countries comparison. CAC interventions are policies that involve the implementation of some form of regulation, be it technological standards or on limits to emissions, and the European Union relies heavily on such policies to regulate air pollution (Lamperti et al, 2019; Schmitt and Schulze, 2011). Empirical evidence suggests that CAC regulations prove to be effective in abating emissions worldwide, and policymakers find these policies attractive for a host of reasons, which may not always coincide with those put forward by economists.

After having briefly explained these two policy levers, we can start outlining the ideal policy proposal. For the complexity and relevance of the issue at hand, a policy mix is preferred over a single policy intervention, since relying on single policy instruments risks exposing policy interventions to a low level of flexibility and resiliency, undermining the potential to successfully tackle the environmental problems in question (Gunningham and Sinclair, 1999). Therefore, it is argued that a policy mix that combines both MBIs and CAC policies is both the most effective and the most efficient way of abating CO2 emissions from the transport sector.

For this reason, our MBI of choice will be carbon pricing, which usually takes the form of tradable permits or taxes on CO~2~ emissions, since it is thought to be the most cost-effective way for reducing CO2 emissions (Lin and Li, 2011; Tvinnereim and Mehling, 2018). By focusing on a carbon tax imposed on fossil fuels and related products, a substitution effect from fossil-based fuels to cleaner ways of energy production is created (Lin and Li, 2011). Moreover, taxing carbon emissions upstream can provide significant revenue to finance, among other things, green transitions in a variety of sectors (Heine et al, 2019; Liu, 2013). Supply-side, CAC approaches to this issue could tackle production, import or export of carbon-emitting fuels via a quota, and limiting, prohibiting or enforcing the use of certain technologies (Lazarus et al, 2015). It must be noted that, when dealing with problems of such complexity on a global scale, a one-size-fits-all policy cannot be recommended. For this reason, the CAC intervention described above must meet some flexibility requirements (Bergquist et al, 2013).

To sum up the proposed policy intervention: a mix of MBIs and CAC regulations is more likely to succeed in tackling the issue of CO2 emissions from the transport sector (Gunningham and Sinclair, 1999), with the literature showing considerable support for this option (Bergquist et al, 2013; Liu et al, 2014; Kathuria, 2002). Therefore, MBIs and CAC policies should be used together to prove effective in tackling the same environmental issue. MBIs, more precisely carbon pricing, will be introduced upstream and its revenue re-invested in further environmental measures which will contribute to the economy’s green transition, while CAC, such as imposing limits on the production, import or export of carbon-emitting fuels via a quota and prohibiting, or imposing, the use of certain technologies (Lazarus et al, 2015) will tackle the supply side of the market. For such a policy mix, it is crucial that policymakers leave a degree of flexibility in the implementation of such policies (Bergquist et al, 2013).

In conclusion, the issue of CO2 emissions from the transport sector is multifaceted and complex. Although this review of the scientific literature suggests a policy mix based on a number of empirical studies, the importance of tailoring these interventions to each country cannot be stressed enough. Simple, linear, one-size-fits-all policies do not exist in the real world, and one should always keep in mind that it is important to ensure efficiency and fairness. For this reason, it is imperative that multilateral, international agreements are introduced as a framework onto which States will be able to tailor their own policies to their own needs and constraints.

Luca Bisio

Cover Image Credits: https://pxhere.com/en/photo/596943 released under CC0.

References

IEA, 2018. Global CO2 emissions by sector, 2018, IEA, Paris https://www.iea.org/data-and-statistics/charts/global-co2-emissions-by-sector-2018

BBC News (2020). Climate change: Scientists fear car surge will see CO2 rebound. [online] Available at: https://www.bbc.co.uk/news/science-environment-52724821[Accessed 12 July 2021].

Bergquist, A., Söderholm, K., Kinneryd, H., Lindmark, M. and Söderholm, P. (2013). ‘Command-and-control revisited: Environmental compliance and technological change in Swedish industry 1970–1990’. Ecological Economics, 85, pp.6-19.

Gunningham, N. and Sinclair, D., (1999). ‘Regulatory pluralism: Designing policy mixes for environmental protection.’ Law & Policy, 21(1), pp.49-76

Heine, D., Semmler, W., Mazzucato, M., Braga, J.P., Gevorkyan, A., Hayde, E.K. and Radpour, S., 2019. Financing low-carbon transitions through carbon pricing and green bonds. World Bank Policy Research Working Paper, (8991).

IPCC (2014). ‘Climate Change 2014: Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change’ [Core Writing Team, R.K. Pachauri and L.A. Meyer (eds.)]. IPCC, Geneva, Switzerland, 151 pp.

Krause, J., Thiel, C., Tsokolis, D., Samaras, Z., Rota, C., Ward, A., Prenninger, P., Coosemans, T., Neugebauer, S. and Verhoeve, W. (2020). ‘EU road vehicle energy consumption and CO2 emissions by 2050 – Expert-based scenarios’. Energy Policy, 138, p.111224. https://doi.org/10.1016/j.enpol.2019.111224.

Lamperti, F., Napoletano, M. and Roventini, A. (2019), ‘Green Transitions And The Prevention Of Environmental Disasters: Market-Based Vs. Command-And-Control Policies’. Macroeconomic Dynamics, 24(7), pp.1861-1880.

Lazarus, M., Erickson, P. and Tempest, K. (2015). Supply-side climate policy: the road less taken. [online] Stockholm Environment Institute (SEI). Available at: http://www.jstor.com/stable/resrep02818 [Accessed 14 April 2021].

Lin, B. and Li, X. (2011). ‘The effect of carbon tax on per capita CO2 emissions’. Energy Policy, 39(9), pp.5137-5146.

Liu, A. (2013). ‘Tax evasion and optimal environmental taxes’. Journal of Environmental Economics and Management, 66(3), pp.656-670.

Logan, K.G., Nelson, J.D. and Hastings, A. (2020). ‘Electric and hydrogen buses: Shifting from conventionally fuelled cars in the UK’. Transportation Research Part D: Transport and Environment, 85, p.102350. https://doi.org/10.1016/j.trd.2020.102350.

Santos, G. (2017). ‘Road transport and CO2 emissions: What are the challenges?’ Transport Policy, 59, pp.71–74. https://doi.org/10.1016/j.tranpol.2017.06.007.

Schmitt, S., Schulze, K. (2011): ‘Choosing environmental policy instruments: An assessment of the ‘environmental dimension’ of EU energy policy’, In: Tosun, Jale, and Israel Solorio (eds) Energy and Environment in Europe: Assessing a Complex Relationship? European Integration online Papers (EIoP), Special Mini-Issue 1, Vol. 15, Article 9, http://eiop.or.at/eiop/texte/2011-009a.htm

Tvinnereim, E. and Mehling, M. (2018). ‘Carbon pricing and deep decarbonisation’. Energy Policy, 121, pp.185-189.